Homeowners Insurance in and around Indianapolis

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Marion County

- Indianapolis

- Avon

- Hendricks County

- Hamilton County

- Wayne Township

- Pike Township

- Carmel

- Fisher

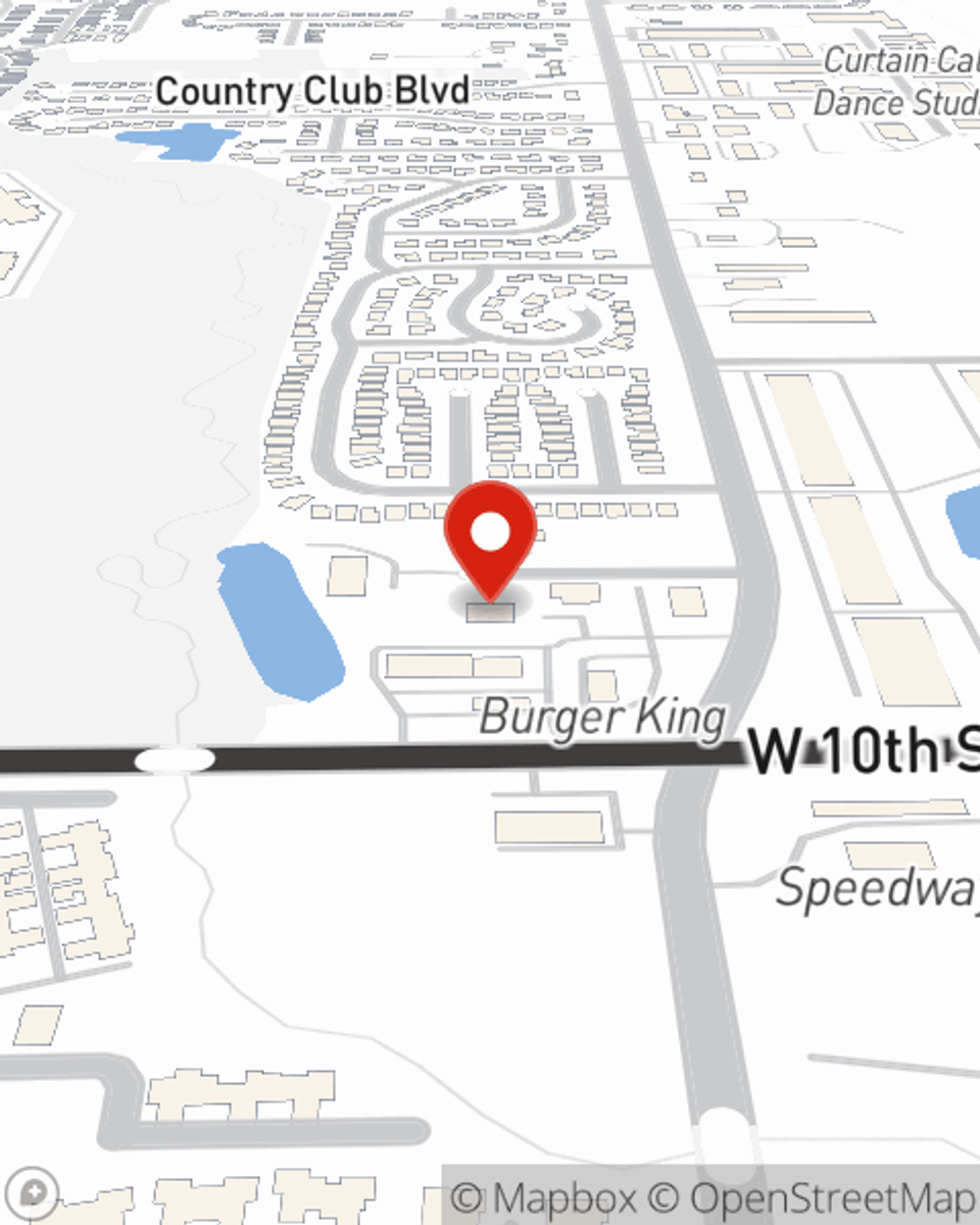

- Speedway

Home Sweet Home Starts With State Farm

Home is where laundry is continuous friends always belong, and you're insured by State Farm. It just makes sense.

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Agent Wanda Bell Brown, At Your Service

For insurance that can help insure both your home and your belongings, State Farm has options. Agent Wanda Bell-Brown's team is happy to help you build a policy today!

Your home is important, but unfortunately, the unpredictable circumstance can happen. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Wanda Bell-Brown can help you put together the right home policy!

Have More Questions About Homeowners Insurance?

Call Wanda at (317) 273-9300 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is homeowners insurance and what does it cover?

What is homeowners insurance and what does it cover?

After investing in your home, it's important to have it insured properly. What are all the policy coverages, forms and exclusions?

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Wanda Bell-Brown

State Farm® Insurance AgentSimple Insights®

What is homeowners insurance and what does it cover?

What is homeowners insurance and what does it cover?

After investing in your home, it's important to have it insured properly. What are all the policy coverages, forms and exclusions?

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.