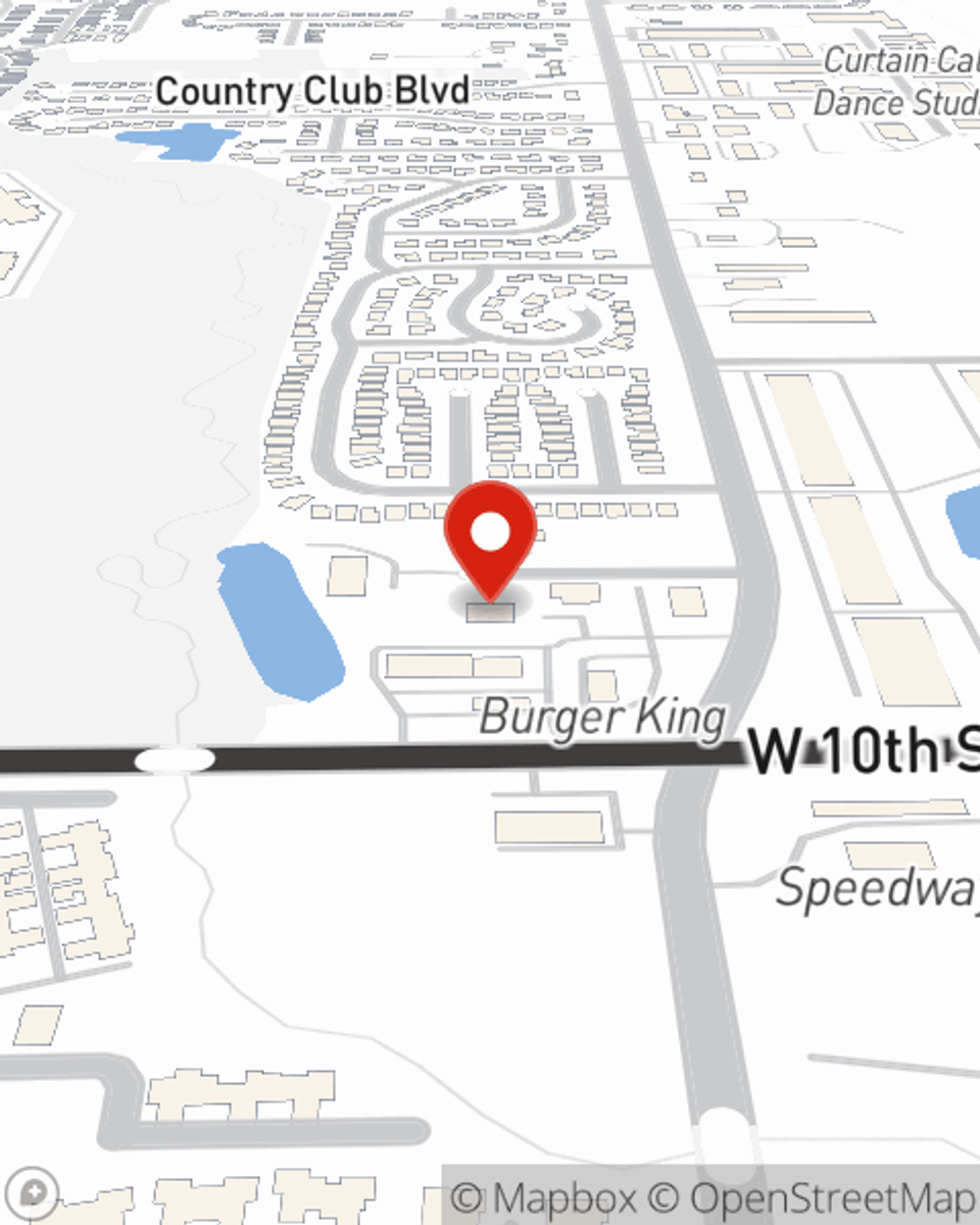

Business Insurance in and around Indianapolis

Looking for coverage for your business? Search no further than State Farm agent Wanda Bell-Brown!

Helping insure small businesses since 1935

- Marion County

- Indianapolis

- Avon

- Hendricks County

- Hamilton County

- Wayne Township

- Pike Township

- Carmel

- Fisher

- Speedway

This Coverage Is Worth It.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or trouble. And you also want to care for any staff and customers who become injured on your property.

Looking for coverage for your business? Search no further than State Farm agent Wanda Bell-Brown!

Helping insure small businesses since 1935

Strictly Business With State Farm

Protecting your business from these potential catastrophes is as easy as choosing State Farm. With this small business insurance, agent Wanda Bell-Brown can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Take the next step of preparation and visit State Farm agent Wanda Bell-Brown's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Wanda Bell-Brown

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.